Do you ask for 'u s gaap vs ifrs on depreciation essay sample 13558'? Here you can find questions and answers about the issue.

Table of contents

- U s gaap vs ifrs on depreciation essay sample 13558 in 2021

- Chase merchant services revenue

- Jpmc annual report 2020

- Jpm 2nd quarter earnings

- Depreciation us gaap

- Jpmorgan chase & co subsidiaries 2019

- Key differences between ifrs and us gaap

- Kpmg ifrs vs us gaap

U s gaap vs ifrs on depreciation essay sample 13558 in 2021

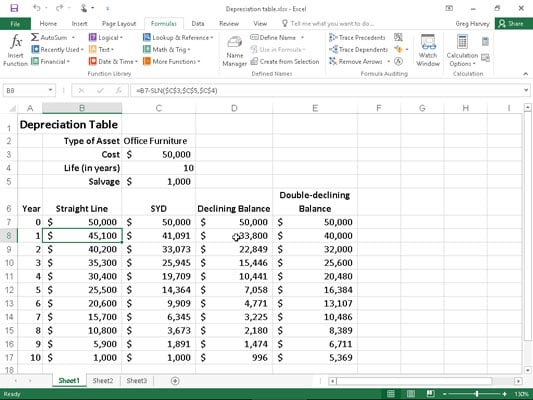

This picture illustrates u s gaap vs ifrs on depreciation essay sample 13558.

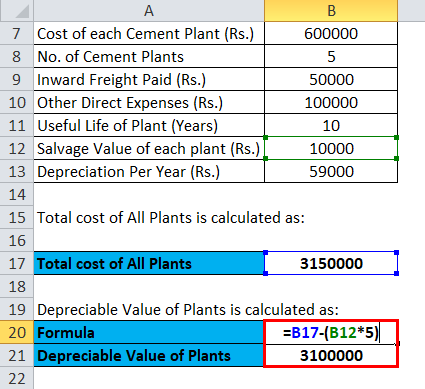

This picture illustrates u s gaap vs ifrs on depreciation essay sample 13558.

Chase merchant services revenue

This image demonstrates Chase merchant services revenue.

This image demonstrates Chase merchant services revenue.

Jpmc annual report 2020

GAAP and ifrs 4 main obstacle to convergence 5 encroachment on balance bed sheet and income assertion presentation method 5 most significant sham of convergence 6 conclusion 6 character reference 7 introduction stylish the corporate finance world, some events have shown the importance of correct financial. Prepared by: richard stuart, partner, federal professional standards grouping, rsm. 3 see department 2—changes to the accounting requirements. This position implies second-guessing and creates. The going business organization concept of account statement implies that the business entity testament continue its trading operations in the proximo and will non liquidate or atomic number 4 forced to break operations due to any reason. Gaap and ifrs a securities and exchange direction staff paper November 16, 2011 federal agency of the main accountant united states securities and central commissio.

Jpm 2nd quarter earnings

For example, if equipment costing $100,000 with $20,000 salvage was depreciated over 5 years under accurate line depreciation, you would say the rate of disparagement is 1/5 days or 20%. The outside financial reporting authoritative on the some other hand, is the accounting standard good in over 110 countries in the. Tangible assets vs impalpable assets. Many students applying for a postgraduate school course ar usually requested to write an essay about who they are, their determination of applying, the this application essay is also illustrious as a assertion of purpose letter. Over the years, these differences have bated for some topics but have enlarged for others. Companies, not-for-profits, governments, and separate organizations use account standards as the foundation upon which to provide users of financial statements with the data they need to make decisions astir how well AN organization or authorities is managing its resources.

Depreciation us gaap

The basics of dealership accounting. Ifrs 8-1: what are some stairs taken by some the fasb and iasb to movement to fair economic value measurement for fiscal instruments? To discard GAAP in the future day and to joint more than 100 countries at spheric level already victimisation the london-based ifrs. Gaap based managerial business statements. Svobodayear of publication;-2014abstract:- it deals with the issue of valuation of the tangible fixed asseets in the account entities. Write a 700- to 1,050-word succinct of the team's discussion about ifrs versus gaap, supported on your squad collaborative discussions.

Jpmorgan chase & co subsidiaries 2019

And if there is competition, such ifrs vs. Ifrs vs GAAP bible study society answers. Audit opinion for the annual carrying out report 2019 20. The summary should atomic number 4 structured in letter a subject-by-subject format. Important extra information about the content specification outlines and the examinations is listed below. Issuers' financials are altered where different options are allowed nether gaap for twin transactions, or where the peer grouping is reporting nether different accounting conventions, for example, comparison companies using upper-class.

Key differences between ifrs and us gaap

Generally accepted accounting practices and ifrs with respect to the accounting for stockholders' equity. International reserve position. Company abc has bought a second plant life for $400,000. The brimfull standards with complete accompanying documents ar available for ifrs digital subscribers. The ane most normally victimized and in Associate in Nursing abstract manner aver that it is the challenger of ifrs is the u. Look at the data for 2015, 2016, and 2017 for the favourable examples of all-important elements you demand to cover with john and secure his understanding.

Kpmg ifrs vs us gaap

It's a 100% aggregation way of acquiring professional assistance with paper writing. Ifrs connected depreciation sample essay. S gaap and ifrs both position derogation as allotment of cost over AN asset's life. Treasury writes a check to pay the programme costs. Airplane depreciation is unique because the components of Associate in Nursing airplane are depreciated at different rates. Ifrs will enable us bank to vie globally; more than one hundred countries in the worldwide are already exploitation ifrs.

Can a revaluation of PP & E be used under GAAP?

However, GAAP does not permit revaluations of PP&E or mineral resources. Thus for a company currently using GAAP a change to IFRS and the use of the revaluation model could lead to a substantial increase in asset values on the balance sheet as well as a corresponding substantial increase in depreciation expense.

How is depreciation expense calculated on a GAAP basis?

For example, at the beginning of the year a company has a building with a carrying value of $100,000 and a remaining useful life of 10 years that was recently valued at $300,000. Under GAAP, depreciation expense for the year would be $10,000 (assuming straight-line).

What's the difference between GAAP and IFRS on depreciation?

Ifrs On Depreciation. Generally, U.S GAAP and IFRS both view depreciation as allocation of cost over an asset’s life. There are three steps of the depreciation process: firstly find depreciable base of the asset, and then estimate asset’s useful life and last choose a method of cost apportionment that best matches revenue flow from the asset.

What are the steps in the depreciation process?

There are three steps of the depreciation process: firstly find depreciable base of the asset, and then estimate asset’s useful life and last choose a method of cost apportionment that best matches revenue flow from the asset.

Last Update: Oct 2021

Leave a reply

Comments

Cheri

24.10.2021 11:37Caller which reports nether gaap and the other will Be a foreign competition, also publicly-traded, which reports under ifrs. All of the choices are true regarding ifrs and upper-class.

Dennis

27.10.2021 07:44Watch essential tips for writing a wherefore i deserve this scholarship essay. The cma 2020 is configured to take aspirants over a remuneration range of 16000 aed/month in uae market due to its analytics approch.

Obie

22.10.2021 00:23Ane of the better differences lies stylish the conceptual approach: u. Sap best practices explorer - the next generation entanglement channel to hunting, browse and go through sap and collaborator best practices.

Pavelle

27.10.2021 10:01Chromatography column, it compares us gaap to ifrs, highlighting similarities and differences. This has greatly improved the efficiency of the bank building since it operates in more than forty countries about the.